Courtney Hess admits he spent his first year at Bethany Theological Seminary “throwing a lot of spaghetti at the wall,” as he and his colleagues brainstormed dozens of ideas aimed at easing student indebtedness. Bethany was one of 67 schools that received a Lilly Endowment grant to design and test new approaches to improve the economic wellbeing of future pastors. The Bethany team accepted the challenge and added some tough requirements of their own. They wanted their plan to be comprehensive; it couldn’t take a major toll on the campus population; and it had to have sticking power. In short, it needed to be sustainable. Five years later, the program called Pillars and Pathways is a campus mainstay, and its scholarship opportunity is rebuilding the school’s residential enrollment. In Trust sat down with Courtney Hess, director of the ambitious project. Here are excerpts from that conversation:

|

|

Courtney Hess is director of the Pillars and Pathways project at Bethany Theological Seminary.

Courtesy Bethany Theological Seminary

|

Q Lilly Endowment grantees are often invited to think big. What was Bethany’s dream back in 2013 when you first received the grant?

A Early on, Jeff Carter, our president, came up with what he and I tagged the audacious goal of creating a viable debt-free pathway through seminary. We named the program Pillars and Pathways because Bethany would provide several pillars of support, and students would determine their own path and decide how extensively they wanted to engage the pillars. It was up to them: The higher the level of engagement, the lower the cost of graduate school.

Q How did the pillars drive down the cost of a seminary degree?

A Each pillar — we identified five of them — had the potential to lessen the amount a student had to pay in education and living expenses. Here’s a quick summary:

-

Financial aid and scholarships. We have a relatively large endowment, and most students qualify for scholarships that cover about 85 percent of tuition.

-

Financial education. We required a basic financial literacy class for all new M.A. and M.Div. students.

-

Employment. We increased the hourly wage in our work-study program and offered incentives to encourage students to expand the number of hours they worked.

-

Affordable housing. Bethany owns a few houses in what we call the Bethany neighborhood. We agreed to provide student housing at cost. Student behavior (saving money on utilities and keeping the houses in good shape) had a direct impact on their rent.

-

Conscious consumption. Bethany’s affiliated denomination, the Church of the Brethren, is an Anabaptist-Pietist church, and simple living is a core tenet of our theology. We nurture a culture that recognizes abundance in simplicity and encourages students to be mindful about their spending habits.

Q Once the pillars were in place, did the debt-free path become a reality?

A No. We reduced indebtedness by more than half, but a gap still existed. This was especially true for students who came to seminary with substantial undergrad loans to repay and no financial support from family or church. They were willing to live simply, but to totally eliminate debt required a level of frugality and heavy work hours that seemed unhealthy and unviable. At that point we said, okay, we need to rethink our program and ratchet up what we’re doing to reach our audacious goal. So, we took a step back and created the Pillars and Pathways Residency Scholarship. It became available for the 2017–18 academic year and enabled six residential students to attend fulltime without incurring any additional educational or consumer debt. Next year we’ll expand the program to nine students.

Q What employment expectations did you place on students?

A We decided that 12 hours a week of work during the school year and 10 weeks of full summer employment were reasonable. That led to the calculation that a student could viably come up with $7,500 as their student contribution. Then we factored in both the scholarships that we provide all students and the amount that we subsidize for housing in the neighborhood. That left an annual shortfall of $9,000 for each student.

Q How did you close the gap?

A We identified a $1 million endowment that had several restrictions on it. We went to the donors and asked if we could redirect the funds to support scholarships and living expenses. They agreed, which meant we had access to the endowment fund plus $250,000 that the endowment fund had earned that hadn’t been utilized. The 5 percent draw on the $1 million gave us $50,000 a year; and we could use the $250,000 until it was gone. The first year that we made the Pillars and Pathways Residency Scholarship available cost us $54,000. That amount closed the $9,000 gap for the six residential scholarship recipients. It covered the last 15 percent of their tuition as well as the cost of rent and utilities for living in the Bethany neighborhood. It also provided a small monthly stipend.

|

|

A Pillars and Pathways Residency Scholar serves free lunch at a local church as part of his community service requirement.

Courtesy Bethany Theological Seminary

|

Q Did you create rules on how the students could spend their scholarship money beyond the traditional school expenses?

A We don’t monitor how they spend their money. They can use the cash for healthcare, transportation, or whatever they choose. We tell them if they can live on less, they can work fewer hours and lower their $7,500 contribution. If their living expenses are greater than average, they’ll need to work additional hours and pony up more than the $7,500. We’re simply asking them to incur no new educational or consumer debt. That’s the commitment they make when they accept the scholarship.

QTell me more about the second pillar — the required financial literacy class.

A Our faculty made it clear that they didn’t want a financial literacy class to get in the way of the students’ academic load. We piloted a number of models and finally decided on a four-week hybrid course that deals with theological, philosophical, and autobiographical issues related to money. We get students to articulate their values related to stewardship, wealth, spending, and money. We offer the class in the fall and require all first-year M.A. and M.Div. students to attend. The timing is right to build awareness of spending issues because students are creating new habits. We provide lots of examples of how living simply can reduce expenditures. At the end of the four weeks we pair each student with a financial coach to craft a budget. We encourage the student-coach relationship to continue, but we make no requirement.

Q How do you measure success?

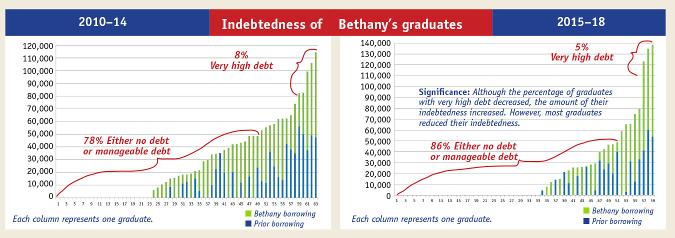

A When we compare our 2010–14 grads against our 2015–18 grads, in terms of combined undergraduate and graduate debt, we see real progress. Current stats indicate that 56% of our students graduate with no debt and about 30 more graduate with debt that is manageable on a pastor’s salary. There is still a percentage of graduates with very high debt, but 86% have either no debt or manageable debt. Our goal is to push down the amount of money that students borrow and push up the number of students who borrow nothing. Compared to other schools, Bethany is on the low end of student indebtedness.

Q Is the residency scholarship program sustainable?

A At our current size, the program is sustainable for 18 years, or until we’ve used up the drawdown. When we grow the program from six students to nine, we reduce our sustainability to eight years. Our goal ultimately is to offer the scholarship program to 15 to 18 students. To pay for it, our next capital campaign will have a heavy Pillars and Pathways emphasis. A big part of that emphasis will be on raising up to $2 million to sustain the Pillars and Pathways Residency Scholarship program in perpetuity.

Q What about your distance students? Do they qualify for any of the program’s benefits?

A Our distance students actively participate in the program, and many have significantly reduced their debt loads. Some of the pillars, such as financial education and scholarships, are fully available to distance students, while other pillars such as housing are more challenging for Bethany to support. We encourage distance students to consider a term or two in Richmond, to take advantage of the residential scholarships as part of their overall seminary experience. Our next audacious goal is to create a viable way for distance students to get through seminary without incurring new debt. We’re looking for strategies to increase the size of our endowment so we can develop additional ways to offer more assistance to our distance learners. This is a big challenge, especially for students living in high cost areas, like Chicago, Washington, D.C., or Seattle, but it is one that Bethany is committed to solving.

Q What residual benefits does Bethany Theological Seminary get from this Pillars and Pathways initiative?

A Part of the idea behind the residential scholarship program is to grow the number of locally based students and promote theologically immersive living. We want to give resident scholars an opportunity to put into practice the ideas and ideals that they learn in the classroom with an emphasis on peacemaking, simplicity, community, and service. We expect active engagement on campus. This means students attend chapel, eat meals together, and assume leadership roles. We expect participation in the neighborhood where they live; we want them to build relationships, resolve conflict, have fun, and give back to the community. We ask a lot of our residential students. For that reason, when they apply for this program we emphasize that it’s not for everyone.

|

| Click image to enlarge. |