Socially screening investment portfolios "though increasingly a trendy consideration" isn't new to churches in America. Presbyterians, Methodists, Baptists, and others have avoided investing in "sin, stocks, alcohol, tobacco, and gambling" for more than a century. Mennonites have avoided investing in defense contractors for decades as part of their peace witness. Roman Catholic-related institutions apply abortion and birth-control screens in their investment process. And socially screened investments are growing rapidly within the broader investment community in the United States, rising 800 percent in just four years from 1995 to 1999, according to a study by the Social Investment Forum, the industry group for socially responsible investing. Many in the investment community still object to screened investing for they believe that only financial criteria should be used in making investment decisions. They contend that socially screening investments will hurt returns, but many academic studies have shown that screened portfolios perform just as well as non-screened investments. The general increase of interest in socially screened investing, however, may not be touching the world of higher education, including seminaries. Commonfund, a nonprofit group that markets investment funds and investment management exclusively to nonprofit organizations and has a number of colleges and seminaries among its 1,450 clients, launched a screened "Social Decision Fund" in January 2000. It canceled the fund last February owing to lack of customer interest, said W. Judson Koss, head of Commonfund's marketing communications office.

Moreover, screened investing is not all there is to socially responsible investing, which has been characterized as a "three-legged stool" with the interdependent components of screened investing, shareholder activism, and community development investing. Two of the legs, shareholder activism and community development investing, have been for the most part overlooked by North American churches and seminaries. Though many national church bodies support shareholder activism and community development investing, most regional church bodies, local churches, and members in the pews haven't considered these options. Seminaries have an opportunity to teach the ministers of tomorrow about stewardship, including shareholder activism and community development investing, while modeling what they're teaching.

Taking a Stand

Shareholder activism involves using share ownership in a company as a means of influencing corporate policy and behavior. This kind of activism includes direct dialogue with company management, filing of shareholder resolutions at annual shareholder meetings, and letter-writing campaigns.

In this arena, the broad ecumenical church community has been a leader through the Interfaith Center on Corporate Responsibility, a coalition of 275 Christian and Jewish institutional investors "including religious communities, denominations, foundations, dioceses, and pension fund" with combined portfolios worth an estimated $100 billion. ICCR was a major player in the South African divestment movement, a vivid example of the potential power of socially responsible investing. Active for more than thirty years, ICCR continues to organize shareholders to push corporations to change their policies on producing apparel in overseas sweatshops or polluting the environment.

Yet few theological schools are involved. The Reverend Tim Smith, a United Methodist minister, was executive director of ICCR for more than twenty-five years and remembers during his tenure there was some "isolated" shareholder activism by seminaries, "but they were generally not plugged in. Using shareholder activism as a part of the training of ministers seems a natural possibility, but the potential has not been realized," said Smith. The South African divestment movement, on the other hand, was the one place where seminaries "participated in a successful campaign. A number of seminaries divested or voted their proxies and, in a few cases, co-sponsored resolutions with corporations calling for divestment," said Smith. Today, seminaries could choose from a myriad of issues "from investment in Burma or Sudan to failing to promote women" and start working with ICCR immediately.

Ironically, considering the increase in screened investing, there is "decreasing involvement in shareholder activism among Protestant denominations," according to Mark Regier, who is on the board of ICCR and coordinates shareholder activism for Mennonite Mutual Aid, a financial services organization that helps Mennonites and other Anabaptists practice financial stewardship. Regier lamented that "seminaries and regional church bodies are not participating in shareholder activism." He points to a current coalition of twenty-nine religious groups of AT&T shareholders who are opposing company plans to add options to its cable programming which include explicit sex. "It amounts to an attempt on the part of AT&T to mainstream pornography," said Regier. Though many seminaries and regional church bodies hold AT&T in their investment portfolios, not one is a part of the coalition. "I would love to see ten seminaries or ten regional church bodies join the coalition," Regier said. "Every new group and every share added to the coalition will increase the chance that we will succeed."

Ironically, considering the increase in screened investing, there is "decreasing involvement in shareholder activism among Protestant denominations," according to Mark Regier, who is on the board of ICCR and coordinates shareholder activism for Mennonite Mutual Aid, a financial services organization that helps Mennonites and other Anabaptists practice financial stewardship. Regier lamented that "seminaries and regional church bodies are not participating in shareholder activism." He points to a current coalition of twenty-nine religious groups of AT&T shareholders who are opposing company plans to add options to its cable programming which include explicit sex. "It amounts to an attempt on the part of AT&T to mainstream pornography," said Regier. Though many seminaries and regional church bodies hold AT&T in their investment portfolios, not one is a part of the coalition. "I would love to see ten seminaries or ten regional church bodies join the coalition," Regier said. "Every new group and every share added to the coalition will increase the chance that we will succeed."

During his seminary career at Associated Mennonite Biblical Seminary in Elkhart, Indiana, Regier took a course on economic justice, but even there no mention was made of the possibility of using shareholder activism to help bring principles of Christian justice to the corporate world. "Many seminaries do not make a connection or think through the theological implications of their investments," said Regier. In the past year, he was invited back to his alma mater to speak about SRI and shareholder activism in the same economic justice course.

More seminaries could bring the implications of economic justice and globalization home by offering a Christian ethics course on the topic, and studying the companies held in the investment portfolio of the seminary endowment. Evaluation of the positive impact of jobs created, tax revenues, and needed products and services would have to be weighed against the potential negative impact in areas such as the environment, human rights, and working conditions. It would be interesting for professors and students to grapple with the actions and policies of companies whose profits helped to pay their salaries and education costs. Christian ethics could not be 'theoretical' in such a course.

A Helping Hand

Community investing is the second area of socially responsible investing that offers seminaries the opportunity to teach and demonstrate ways for people of faith to stand with the poor, following Jesus's example. In the past twenty years, interest in socially responsible investing has spawned an impressive array of community financial institutions that make capital available to poor people and the non-profit institutions that serve them.

These new institutions can serve many of the institutional needs of seminaries and other church institutions, while helping poor people and poor communities help themselves, the proverbial win-win opportunity. For example, many community development banks and credit unions provide the depositor with federal insurance, competitive interest rates, and services such as electronic transfers, all while making loans to build affordable housing in the inner city or financing locally owned small businesses in rural America. Accomplishing two purposes with the same money is good stewardship.

The United Methodist Board of Pensions is among the national church bodies that invest in community development programs. And the board of directors of Friendship House, an American Baptist-affiliated community and social service center which serves poor people in Hamtramck, Michigan, recently deposited a substantial portion of its reserve funds into a money market account run by a community development bank. Reverend Sharon Buttry, executive director, said, "It just made sense for an agency which serves the poor by direct services to make capital available to the poor even as we meet our own institutional needs." Even if a seminary or church institution has no endowment they could use a community development bank for some of their reserve funds and, in so doing, make capital available to low-income people.

But on the whole, regional church bodies, local churches, and individual church members still have a long way to go. Seminaries need to train and teach future ministers about the community development institutions that serve the poor so the regional church bodies, local churches, and individual church members will "stand with the poor" by making deposits in these new institutions. Seminaries need to undergird their words with action, making deposits into these same community development institutions.

Can shareholder activism and community development investing really come together to educate? Don Shriver, who was president of Union Seminary in New York City during the South African divestment movement in the early 1980s, talks proudly of the process which ended in the seminary endowment divesting from South Africa. Students and faculty were involved, along with the board of trustees. The investment committee of the board of trustees voted to make a $5,000 loan to an ecumenical international development loan fund as a positive action to go along with divestiture. Shriver admits the loan was only "a symbolic offer of support," but it made the point that by coupling the two actions, the seminary "educated more by what we did than by what we said."

The church surely needs more seminary education like this in the 21st century.

In Trust Survey

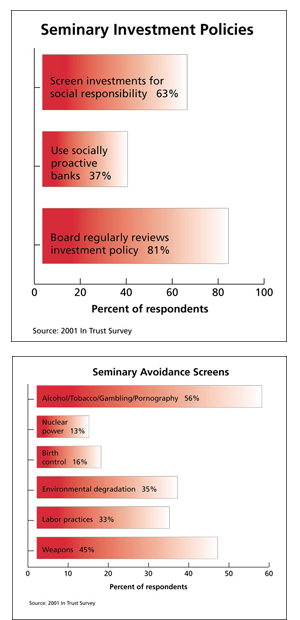

Charts accompanying this article come from a 2001 In Trust survey of graduate theological schools. Ninety-seven schools responded to the survey, almost half of whom included explanatory comments.

Here's a sample: We review our holdings on a quarterly basis, looking specifically at merger and takeover actions that may have let back-door investments in.

-Carey Hall, Vancouver, British Columbia

For our institution, the notion that socially responsible investing equates to a reduced earnings rate has been dispelled during the last fifteen years. . .

-Central Baptist Theological Seminary, Kansas City, Kansas

Internationally and domestically, we pursue community development investing that widens opportunity and empowerment for economically disadvantaged communities and individuals.

-Eastern Mennonite Seminary, Harrisonburg, Virginia

Resources

National Community Capital Association 215/923-4754

www.communitycapital.org

Lists community development financial institutions.

Roster of Community Development Banks

www.communityinvest.org/searchbanks.htm

Lists some banks overlooked by NCCA.

Center for Community Self-Help 800/582-6757

www.self-help.org

Offers a credit union money market account, among other things.

Domini Social Investments 800/582-6757

www.domini.com

Offers socially responsible investments.

Interfaith Center on Corporate Responsibility 212/870-2295

www.iccr.org

Social Investment Forum 202/872-5319

www.socialinvest.org

Offers information on the practice of socially responsible investing.