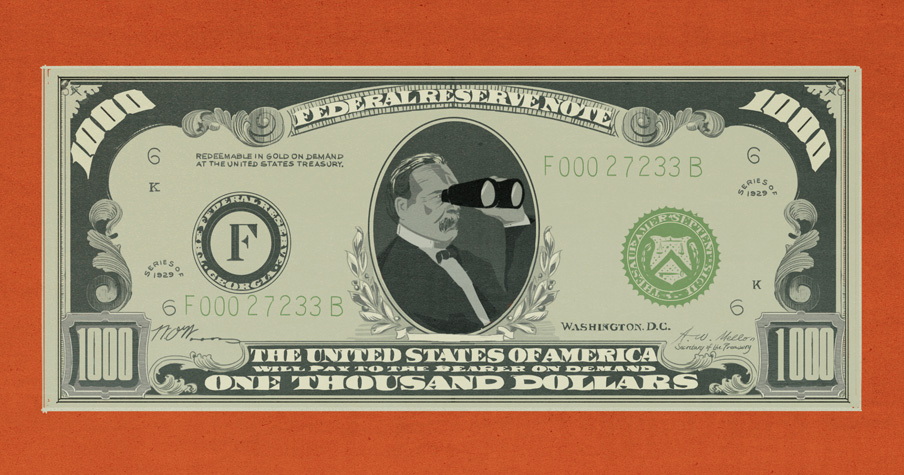

Illustration by Andrea Ucini

Endowments – long-term investments designated for a special purpose – can be seen as a panacea or a sign of wealth for theological schools, but they’re more complex than that. In Trust’s Matt Hufman talked with Doug MacGray, founder of Stonecrop Wealth Advisors in West Chester, Pennsylvania, and a member of the board of Missio Seminary, about the care and cultivation of endowments.

Here are a four takeaways about responsible stewardship from the conversation. To view the full video interview click here

Endowments are a matter of stewardship: As stewards, we want to make sure we’re investing in a manner where the investment is going to grow. With endowments, you’re stewarding not just money but also the intention of the donors. They gave the money in good faith that it would be used for certain and specific purposes, and it is certainly not good stewardship to go against a donor’s intent. So, on one hand, good stewardship is making sure that those assets are productive, and you have a very well thought out investment plan and policy. On the other hand, you make sure you’re being good stewards by using it for the purpose for which it was given.

It takes work to grow an endowment: An endowment and long-term investments are often back-burner issues. Seminaries are such lean institutions that they don’t often have a director of planned giving or some other large gifts officer handling that. They have one or two people in development that are trying to meet an annual giving number, so those longer-term dollars are often just not a priority. Capital campaigns are front-burner issues because they are often a lot more attractive to the board and to the administration. Seminaries can grow and raise a larger endowment if they are properly managed and cultivated. With a large endowment, it can get these institutions through difficult times because you’ve got this perpetual flow of income that’s coming in from the investment. That can be a solid source of financial support that’s coming in that you can count on, even if enrollment goes down temporarily or something else happens.

Endowments have restrictions and can’t be treated as general funds: There are people on boards who don’t like endowments or the concept of endowments, and there are people who say: “If we have access to this wealth, we should be using it now, and we should be using it for God’s purposes today.” I’ve heard that argument and people need to be disabused of that regarding the money that already exists in an endowment.

Now, there’s nothing to say that someone may be able to push the board to say, “Let’s stop trying to raise money through the endowment when we need to be raising it for these other things.” That’s a whole different discussion. But once it’s in the endowment, stewardship takes on a different meaning for those dollars.

Endowments have restrictions and are for specific purposes; changes need approval: If you want to change the endowment, you can go to the donor if they’re still alive and ask, “Will you release a restriction?” But older endowments and more radical changes should go to the state attorney general because that’s who is in charge.

For example, if the change is a real specific thing because the endowment’s purpose is no longer remotely involved with the school anymore, there would be a strong argument to the attorney general that the money should no longer be endowing the institution and should be given to another charitable institution. Since this seminary has drifted away from that mission or purposely gone away from that mission, that money is not properly used to support this institution anymore.

So if the potential exists that the original intent of the money can be so radically different from where the institution is now, there could be an issue there.