Fiduciary oversight can be intimidating for new board members. The chief financial officer or finance committee hands the board a stack of charts and tables, presents a few highlights, and asks if there are any questions. Where does the new board member start?

New trustees who want to understand their school's finances should start with three basic documents:

-

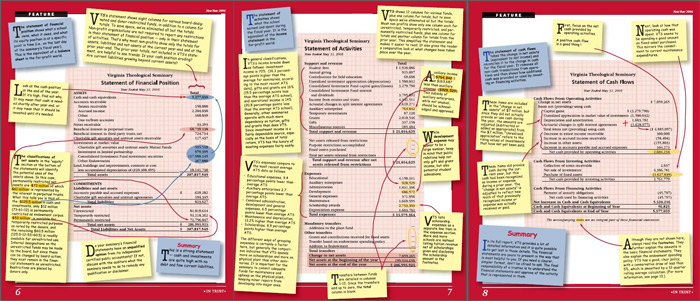

The statement of financial position or balance sheet

-

The statement of activities or income statement

-

The statement of cash flows

These three, along with their footnotes, summarize a school's financial position. A trustee who knows how to read them intelligently and use them to ask the right questions can move beyond mere rubber stamping.

In Trust recently asked Judy E. Stanfield to provide a guide to reading basic financial documents. A certified public accountant for more than 25 years, Stanfield is a principal in the Rockville, Maryland, accounting firm of Strack Stanfield, LLC. She agreed to look at any theological school's financial statements, highlight areas of particular interest, and point out where boards need to pay special attention. She focused not on finding problems, but on asking the right questions.

Virginia Theological Seminary, an Episcopal school founded in 1823, agreed to provide its annual financial report. The seminary's dean-president, Martha J. Horne, supplied all the requested documents with no strings attached and without knowing (at first) who the auditor would be. Although Stanfield was formerly vice president for finance at Wesley Theological Seminary in Washington, D.C., she has no connection with Virginia Theological Seminary.

Virginia is by no means a typical seminary. One of the two oldest Episcopal theological schools -- the General Theological Seminary in New York was founded slightly earlier -- its home is a spacious tree-filled campus in Alexandria, Virginia, just a few minutes from Washington, D.C. Its endowment started growing in the 19th century, and its assets eclipse most other seminaries' by a large margin. The seminary's impressive portfolio has allowed it to be especially generous in financial aid, with a majority of its operating expenses coming from investment income, not tuition. But with heavy dependence on endowment have come some challenges as well -- especially in donor relations and fundraising.

To put human faces beside these numbers, In Trust talked to Martha Horne and her chief financial officer, Mary L. Hix, about their blessings, how they educate their trustees, and how they stay entrepreneurial.

For an alternate view, we called Paul F.M. Zahl, dean-president of Trinity Episcopal School for Ministry, a newer, smaller Episcopal seminary for a conversation about a completely different financial philosophy.

(Click image for larger view of the annotated VTS Statement of Financial Position.)