|

| Click here to view larger chart. |

Why does a school need directors and officers (D&O) liability insurance? Why spend all that money? Don’t the federal Volunteer Protection Act of 1997 and similar state laws take care of the problem?

The answer to the first question is that the legal expenses of defending a D&O claim—even one that is unjustified—are often far more than any payment made to the plaintiff for damages. There are several answers to the second question:

1. Under the Volunteer Protection Act, a nonprofit does not have immunity for the legal expenses to defend a lawsuit. As Example A below indicates, the cost of defense may far exceed any damages paid.

2. The law does not provide immunity from certain types of claims, such as those that are employment-related, and most claims against nonprofits are in this category.

3. While the law does save the trustees, it does not save the school, and it is the school and its endowment that need to be protected from the expense of outrageous lawsuits.

Example A

A nonprofit agency that provides services to the mentally ill was sued for an alleged breach of contract by a staff psychiatrist. The D&O insurer defended the claim, which did not ultimately go to court, and wound up paying out $850,000: $250,000 in damages and $600,000 in legal expenses.

|

|

Fortunately, the agency’s policy had the “duty-to-defend” provision, which constrains the insurer to provide the attorney even if the suit is groundless. In earlier versions of the D&O policy, the organization would mount its own defense and then seek reimbursement of the legal costs from the insurance company. This particular agency had a policy that provided a $1 million limit of liability. If the cost of defense and damages had exceeded the policy limit, the organization would have had to pay the difference. A nonprofit organization advertised an open position for a bus driver. The individual would transport community members who did not have a vehicle to and from appointments and on errands. The organization received seven applications and interviewed six of the applicants. The seventh applicant alleged he was not interviewed because of his age and filed suit against the nonprofit for age discrimination. The nonprofit denied any wrongdoing but settled the case for $15,000 to avoid full litigation costs.

|

Example B

A nonprofit organization advertised an open position for a bus driver. The individual would transport community members who did not have a vehicle to and from appointments and on errands. The organization received seven applications and interviewed six of the applicants. The seventh applicant alleged he was not interviewed because of his age and filed suit against the nonprofit for age discrimination. The nonprofit denied any wrongdoing but settled the case for $15,000 to avoid full litigation costs.

Example C

A female employee who had been working for a nonprofit for two years discovered that a male employee with no experience had just been hired to work in a similar position at a salary higher than what she received. After a year, the male employee was promoted to a position over the female employee. The female employee confronted her supervisor about the situation and the supervisor declined to offer an explanation. The female employee brought a sex discrimination suit against the nonprofit, claiming that she was next in line for promotion based on seniority. The nonprofit settled out of court; the cost of defending it exceeded $70,000.

The newer D&O policies provide for board employment- practices coverage.

* * * *

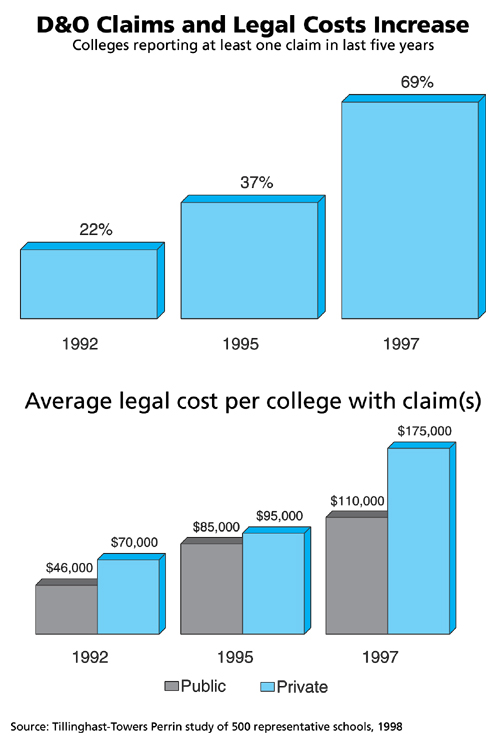

D&O coverage is not cheap, according to the most recent survey of nonprofit organizations conducted by the consulting firm of Watson Wyatt Worldwide (now a part of Tillinghast-Towers Perrin). This survey takes into consideration issues like general market conditions, insurance premiums, which insurance carriers are providing the coverage, and the nature of the claims submitted. Private schools pay on average $16,000 a year to carry for coverage. According to the same survey, 95 percent of private education institutions do carry the insurance.

As to whether such insurance is necessary, the survey also found that 36 percent of the 726 organizations that responded experienced one or more D&O claims over a ten-year period. This represented a noticeable increase from the 17 percent reported in 1993. Eighty percent of the claims identified concerned employment-related practices such as wrongful termination or discrimination in hiring or promotion.

A well-run school that has the proper policies and procedures in place can avoid many of the types of claims described above and thereby reduce the need for D&O insurance. Nonetheless, claims for injury or alleging malfeasance can come from a variety of sources and will be a drain on the resources of the institution and its leadership.

Use the Insurance Coverage Checklist to make sure the school’s policy is the most current form available. Check with the person responsible for the insurance to see if the school has an up-to-date policy.

Some people worry that if their organization has D&O insurance it will attract claims and that the more insurance it has, the larger the claim. The leadership of a nonprofit always has the option of going without coverage. If the organization is small in both staff and asset size, the option of “going naked” might be practical, since there is little to lose in the event of a claim. But in consideration of the board, those who serve without compensation, the expense is small.

While not absolutely necessary, a D&O policy written on the most comprehensive form available is “sleep” insurance—it gives a measure of comfort to those in positions of authority.

Coverage Checklist

- Does the coverage provide a broad definition of insured, including the school, directors, officers, trustees, employees, and volunteers?

- Is the coverage on a duty-to-defend basis?

- Are the defense costs outside the limit of liability?

- Does the policy provide employment practices coverage?

- What are the exclusions? Which of these can be deleted?